Medical Mileage Deduction 2025 - 1, 2025, the standard optional mileage rate you can use to claim those eligible miles will go to 67 cents per. Do you drive for business, charity or medical appointments? 2025 Tax Medical Deductions Flore Jillana, The medical mileage rate is the amount of money you can deduct from your taxes. Let’s dive into the medical expense deduction and what role medical mileage plays.

1, 2025, the standard optional mileage rate you can use to claim those eligible miles will go to 67 cents per. Do you drive for business, charity or medical appointments?

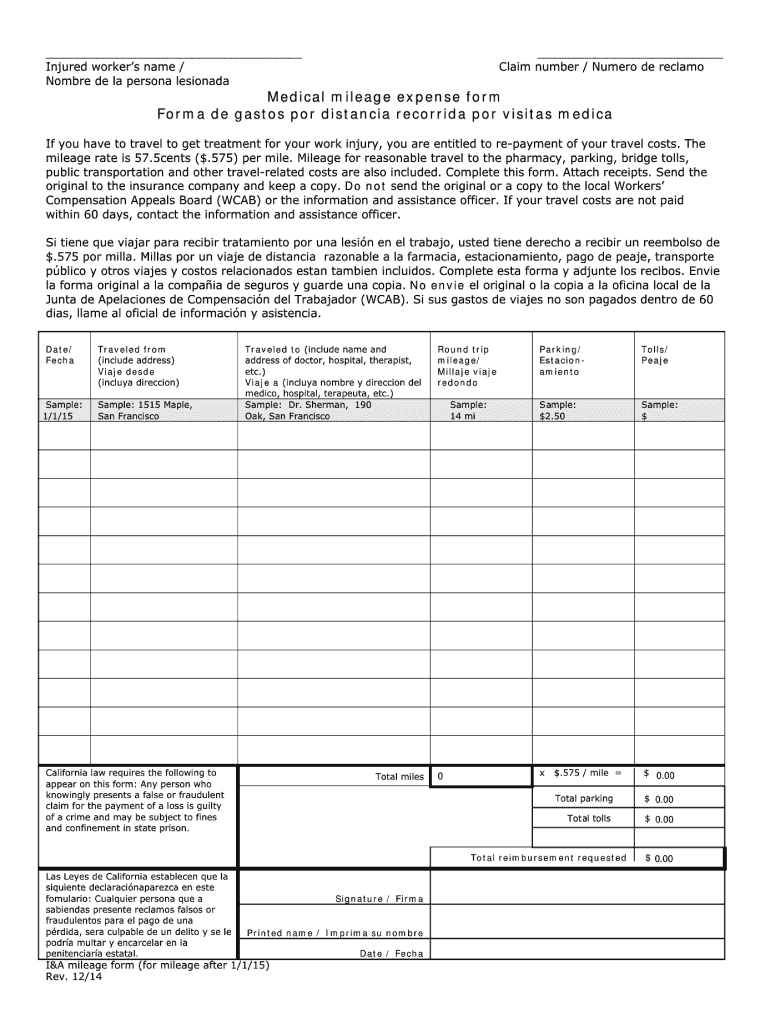

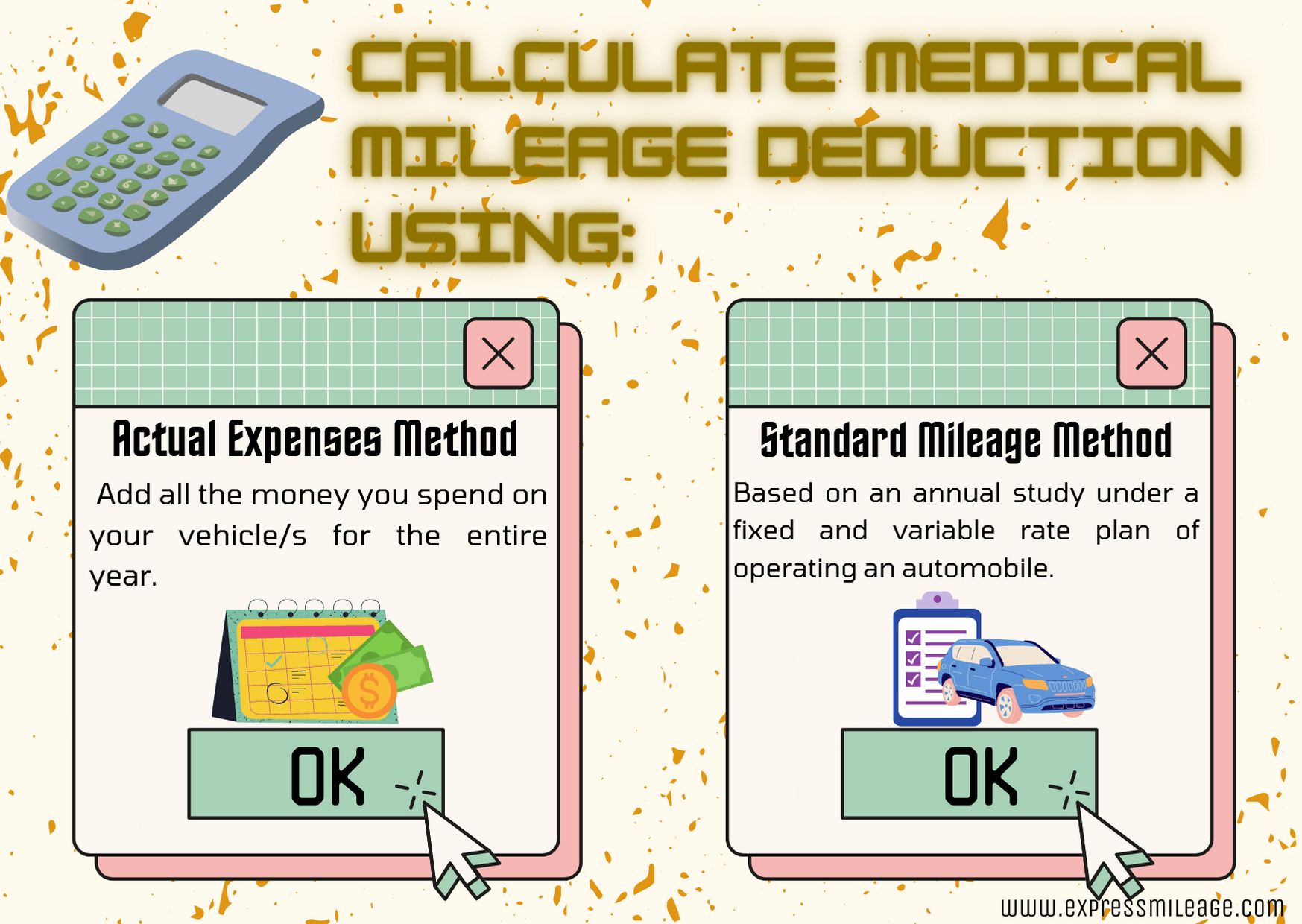

Medical Arts Pharmacy Fayetteville Arkansas Medical Mileage Deduction, You may be eligible for a considerable tax deduction if you frequently travel for medical reasons. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

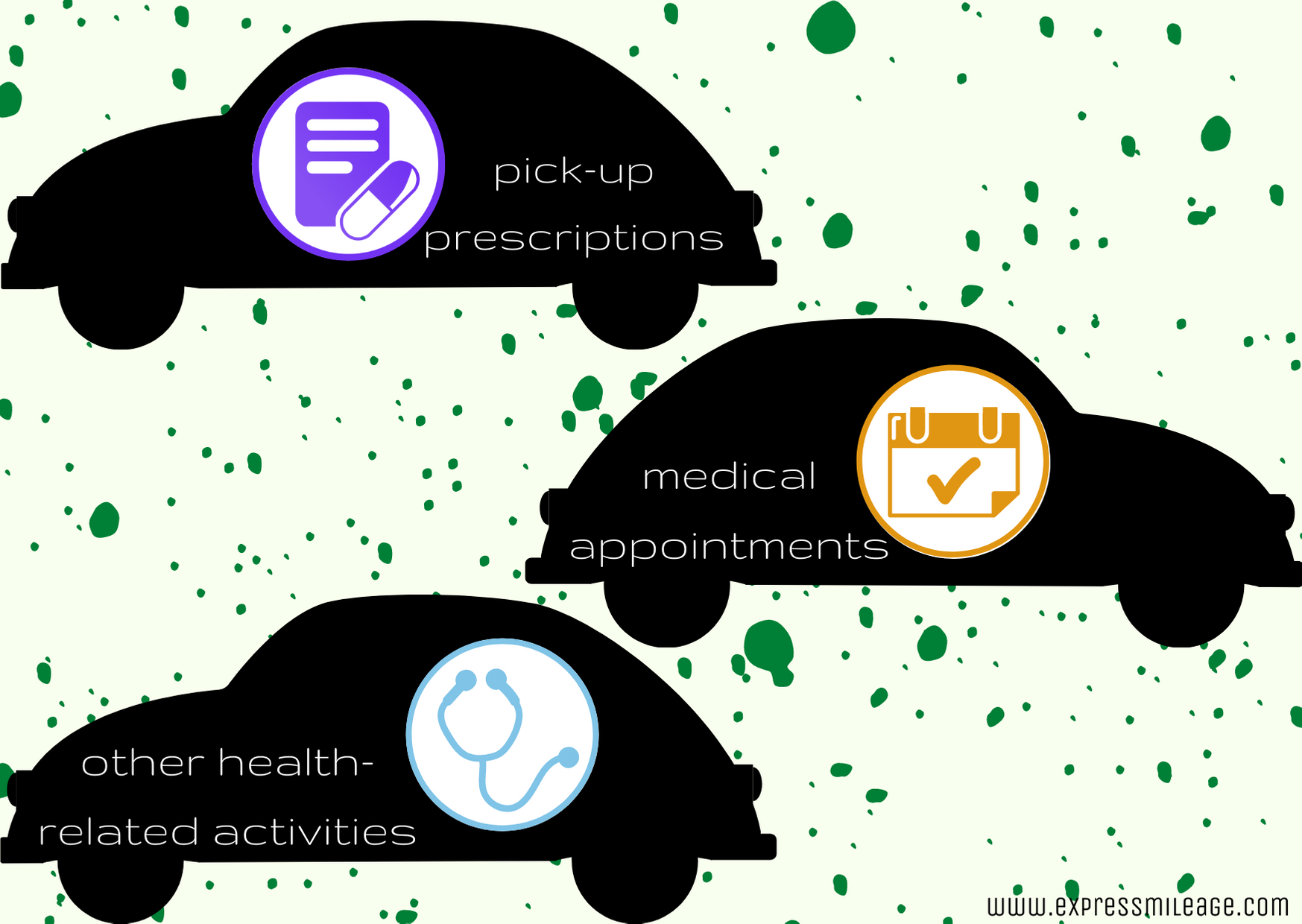

Medical Mileage Deduction on you taxes ExpressMileage, The medical mileage rate is the amount of money you can deduct from your taxes. The rc4065 is for persons with medical expenses and their supporting family members.

Medical Mileage Deduction 2025. You can deduct medical expenses that exceed 7.5% of your adjusted gross income (agi). The guide gives information on eligible medical expenses you can claim on your tax return.

Let’s dive into the medical expense deduction and what role medical mileage plays.

How to Claim Your Medical Care Expense Deduction ExpressMileage, In this comprehensive guide, we'll steer through the new 2025 irs mileage rates, delving into what they mean for you, how they compare to previous years, and. Today, the tax agency announced that on jan.

Deduction, Mileage, Need To Know, Everything, Medical, Business, 22 cents per mile for medical and moving purposes. Here are the details about claiming mileage on taxes.

Medical Mileage Deduction on you taxes ExpressMileage, This notice provides the optional 2025 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business,. The medical mileage rate set for 2025 is 21 cents per mile.

2025 Itemized Deductions Form Becka Klarika, 65.5 cents per mile for business purposes. The 2025 medical mileage rate is 21 cents per mile.

What Is a Medical Mileage Deduction and How to Claim It? MileIQ, 17 rows find standard mileage rates to calculate the deduction for using your car for. The medical mileage rate for 2023 was 22 cents per mile.

Medical Mileage Form 2023 Printable Forms Free Online, The rc4065 is for persons with medical expenses and their supporting family members. The medical mileage rate is the amount of money you can deduct from your taxes.